The Payday app is widely used in Nigeria for financial transactions. However, numerous users are encountering issues, primarily with virtual cards and customer support. In this post, we will delve into the Payday app issues in Nigeria, share personal experiences, and suggest an alternative solution, such as utilising the Chipper app.

You can skip to read our guide on chipper here.

Problems with Virtual Cards:

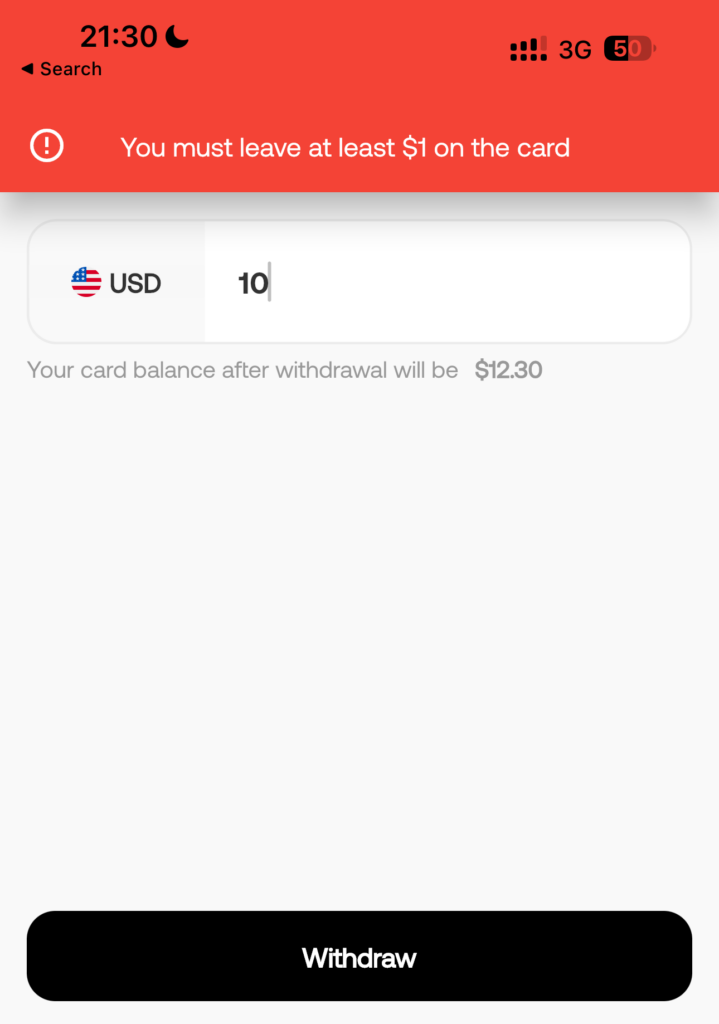

Many Nigerian users have faced challenges with the virtual cards provided by the Payday app. These issues encompass delays in generating cards and difficulties linking them to accounts for transactions. Some users have also encountered hurdles in withdrawing funds from their virtual USD cards, as the app consistently displays a message stating that they must retain at least $1 on their card, even when the balance exceeds this threshold.

Personal Experience: Payday App Issue

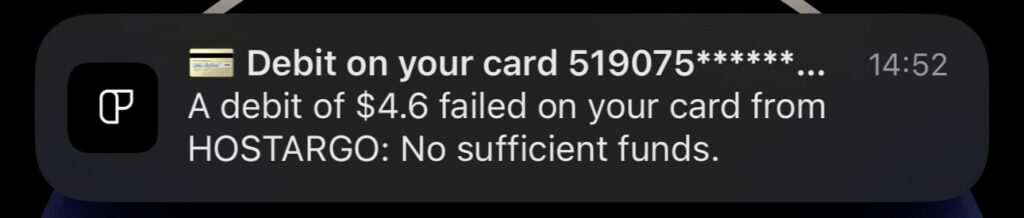

As a Payday app user, I’ve also confronted issues related to virtual cards and fund withdrawals. Despite having $22 in my account, a $4.6 transaction on Amazon failed due to perceived insufficient funds. Similarly, the app prevented me from withdrawing money from the virtual USD card, consistently displaying a message to maintain a minimum of $1, even when I exceeded this requirement.

Tweets from Other Nigerian Users:

Other Nigerian users have taken to social media to express their frustrations with the Payday app. Here are some examples:

- “I’m just tired. Payday would leave Google soon. They are on 2.0 already. Because the 1 rating is getting too much. With the way this app is going, I see them folding up soon. My $41 is still hanged with them. Once they release I would uninstall immediately.“

- “I made a transaction on my payday account on 23rd March till date is still on queued I have contacted the support via app till now I haven’t gotten any response and the transaction I have missed the goods I need my money to reverse on my account please.“

- “I’ve been trying to reach payday customer care because they locked my account for no reason all to no avail please I need to make transactions on the account because all my funds is in the app.”

Inadequate Customer Support:

Many Nigerian users have reported poor customer support from the Payday app. Some users have been unable to reach the support team through multiple channels, and when they do get a response, it is unhelpful or non-responsive. This is unacceptable behavior, especially when users are dealing with their hard-earned money.

Exploring an Alternative, Chipper App:

Given the challenges posed by the Payday app, exploring alternative solutions becomes imperative. The Chipper app offers a viable alternative, providing an array of services including bill payments, money transfers, and virtual cards. Chipper is praised for its reliability and responsive customer support. Their dollar rates are slightly higher than the blackmarket, however worth the service. To have an idea of the naira black rate for dollar, pound and euro, you view the currency rates at fxrate.ng.

Conclusion:

Nigerian users of the Payday app are facing issues with virtual cards and poor customer support. As a user, it’s frustrating to deal with these problems when you need to make online purchases or withdraw your money. While the Payday app may have been a reliable platform in the past, it’s clear that there are problems that need to be addressed.

If you are experiencing issues with the Payday app, consider trying the Chipper app as an alternative solution. You can read our guide on chipper here.

It’s important for financial platforms to be transparent, reliable, and responsive to their users’ needs. Nigerian users of the Payday app deserve better, and we hope that these issues will be resolved soon.