Are you looking for a quick and easy way to get some cash in Nigeria? Do you want to avoid the hassle of dealing with banks, collateral, and high interest rates? If so, you might be interested in trying out some of the legit loan apps that are available in Nigeria in 2023.

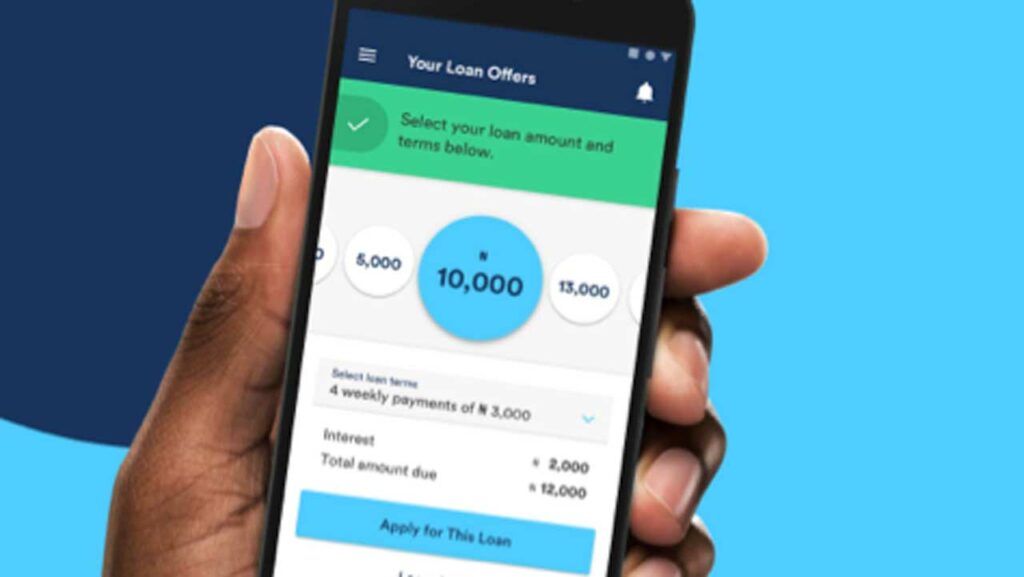

Loan apps are mobile applications that allow you to borrow money from a lender without any paperwork, guarantor, or security. You can apply for a loan anytime, anywhere, and get approved within minutes. You can also choose the amount and duration of the loan, and repay it through your bank account or mobile wallet.

However, not all loan apps are created equal. Some of them may charge hidden fees, have poor customer service, or even scam you out of your money. That’s why you need to be careful and do your research before choosing a loan app.

To help you out, we have compiled a list of the top 3 legit loan apps in Nigeria 2023.

These are apps that have been tested and verified by thousands of users, and have positive reviews and ratings. They also offer competitive interest rates, flexible repayment terms, and excellent customer support. Here they are:

1. Carbon Loan App

Carbon is one of the most popular and trusted loan apps in Nigeria. It offers loans ranging from N1,500 to N1 million, with interest rates starting from 5% per month. You can repay your loan in 4 to 64 weeks, depending on the amount and your income. Carbon also rewards you with lower interest rates and higher loan limits as you repay your loans on time. You can also use Carbon to pay bills, buy airtime, invest in mutual funds, and access free credit reports. To apply for a loan from Carbon, you need to download the app, register with your BVN and bank account details, and provide some personal information. You will get an instant decision on your loan application, and if approved, the money will be sent to your bank account within minutes.

Click here to download Carbon for IOS.

Click here to download Carbon for Android.

2. FairMoney Loan App

FairMoney is another reliable and reputable loan app in Nigeria. It offers loans from N1,500 to N500,000, with interest rates ranging from 10% to 30% per month. You can repay your loan in 4 to 26 weeks, depending on the amount and your income. FairMoney also gives you discounts on interest rates if you repay your loans early or refer your friends to the app. You can also use FairMoney to buy airtime, data, and electricity tokens. To apply for a loan from FairMoney, you need to download the app, register with your phone number and BVN, and provide some personal information. You will get an instant decision on your loan application, and if approved, the money will be sent to your bank account within minutes.

Click here to download Carbon for Android

3. Branch Loan App

Branch is a global loan app that operates in Nigeria as well as other countries like Kenya, India, Mexico, and Tanzania. It offers loans from N1,000 to N200,000, with interest rates starting from 15% per month. You can repay your loan in 4 to 40 weeks, depending on the amount and your income. Branch also rewards you with lower interest rates and higher loan limits as you build your credit history with the app. You can also use Branch to send money to other bank accounts or mobile wallets. To apply for a loan from Branch, you need to download the app, register with your phone number and BVN, and provide some personal information. You will get an instant decision on your loan application, and if approved, the money will be sent to your bank account within minutes.

Click here to download Carbon for IOS.

For fx rates in Nigeria..read our post on fxrates.ng.